Get in touch with Get Novated for all your car finance options.

Are you searching for a novated lease package that makes the most of your pre and post tax deductions?

Or are you an employer looking to offer an attractive package option for your valued employees?

Novated Lease not for you?

Get Novated have a wide range of Lenders and experienced team to work with you for all your financial needs, including vehicle, motorcycle, leisure, debt consolidation, equipment and commercial lending.

Get Novated is here to help you with all your financial needs and requirements.

Get in touch with our experienced team today for a personalised quote that takes into account your current needs, circumstances, budget and lifestyle.

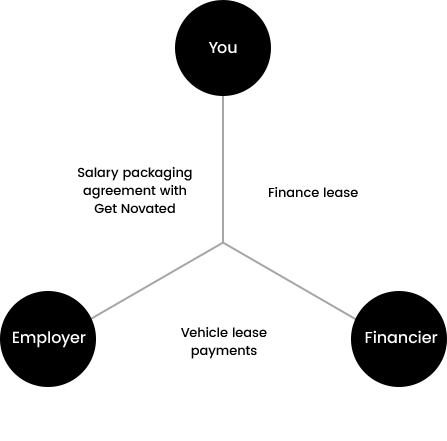

Novated Lease vs Car Loan

Choosing your best car finance options can be quite daunting.

Our expert team can talk you through the different options.

What’s the best option for me?

What saves you more?

Let’s explore both options to help you decide.